Opening an LLC was Never been Easy before

No Big Lawyer Fees, No Paper works, No Headaches

Why Choose US

A team of professionals

We’ve helped millions of business owners to set up and launch their business, hassle and mistake free. We’d be honored to do the same for you!

We’ve got your back

Priority support - Our secure business formation services allows you full access to our 24/7 priority support team, and we’ll be with you every step of the way.

Fast, easy, no stress

We provide you with an easy and safe way to form an LLC online, so you can focus on the parts of your business that you love.

One Stop Service

You do not need to go anywhere else for everything you need for your Business.

Are You Ready to Start an LLC ?

If you were feeling anxious about forming an LLC business before this post, it’s normal. After all, it can seem like a giant leap into the legal unknown.

Now that you know how to start an LLC, there’s nothing stopping you.

Follow our steps one at a time, and if you get stuck or need further advice, revisit this guide or reach out to other business owners in your area.

Support is available every step of the way.

Step by Step Guide to Open Your LLC

Step 1. Name Your LLC

- Your name has to be unique to avoid confusion with an existing registered company.

- It must contain the words LLC or limited liability company in the name, and you can’t use financial words such as insurance, trust, bank, and inc.

Rules vary from state to state, as they do with every step of starting a a limited liability company. You’ll find your state’s laws on its website.

Step 2. Select Your State

You can choose to register/form your LLC in any U.S. state, regardless of your location.

Your home state is the most convenient choice in most circumstances. Because local solicitors and lawyers are familiar with their home state laws regarding LLC formation and operating guidelines, it’s helpful to have government offices within reach.

LLC business owners choose to register out-of-state due to lower set up, running costs, self-employment tax, and sales tax.

When registering your preferred business type in a state other than your own, you’re required to have a physical address to receive official mail. You can appoint a registered agent’s office to act on your behalf.

All 50 states have websites dedicated to how to start and run an LLC.

Many larger and different types of LLCs form businesses across multiple states and use a national registered agent to receive official mail on their behalf.

Make sure you’re aware of each state’s requirements for establishing and maintaining an LLC.

Step 3. File Articles of Organization

The first step towards registering your business is to file an article of organization form with your state. Often states use different terminology, such as a certificate of formation or a certificate of organization.

You can download the articles of organization form for free from your state website. Filing fees are state-dependent, ranging anywhere from $50 to $800. General costs differ and you can check them out per state in this LLC cost post.

Once approved, you’ll receive a state certificate of organization proving your LLC’s existence as a legal entity within your state. And that’s great news because you can then do business!

Once you begin doing business, you’re required to pay yearly limited liability fees to your state. This is also known as Annual Registration Fees, Annual Certificates, Annual Reports, or Franchise Tax Reports.

Fees are unavoidable and required to keep your business compliant with your state, regardless of your LLC’s activity or profit.

Step 4. Choose a Registered Agent

A question most potential LLC owners ask is, “Can I set up an LLC on my own?” Yes, but regardless of your LLC’s location, you need a registered agent and a registered office because of due process.

A registered agent is an individual who will receive legal and other documents on behalf of your business, such as subpoenas, regulatory and tax notices, and correspondence.

In most states, if someone wants to sue you, the court cannot proceed until it has served you. And for that, you need a registered address and be open during regular business hours and available to the public.

Depending on your state laws, you could nominate yourself or appoint your business to act as its own registered agent.

If you want to hire a registered agent service and reduce your paperwork, finding one isn’t difficult. Still, sourcing a legitimate one at a reasonable price can be.

Check with your secretary of state’s office and ask for a recommendation, or, if you want to go the simpler route, register your LLC here at Tailor Brands!

Step 5. Create an Operating Agreement

An operating agreement records your LLC’s setup, organizational structure, daily duties, and general rules.

Most states don’t require an LLC to create an operating agreement. But if you’re looking for investors or end up in court because of internal disagreements between partners (it happens), you’ll need one.

An operating agreement covers essential points, such as each member’s responsibilities, profit, and loss allocation, proceedings when a member wants to leave or sell their share, and more.

Step 6. Apply for EIN

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is used to identify a business entity. It’s a 9-digit number assigned by the IRS to identify taxpayers who are required to file business tax returns.

There are 3 ways you can apply for an EIN:

The preferred method when applying for an EIN is online. Be aware that the online application is available Monday through Friday from 7 a.m. to 10 p.m. Eastern time. Once the application is completed, an EIN number will be issued immediately.

There is also the option to mail in the completed Form SS-4 to the IRS address listed on the Instructions for Form SS-4 PDF or see “Where to File Your Taxes” (for Form SS-4). You’ll receive your EIN in the mail in approximately 4 weeks.

Lastly, you can fax the completed Form SS-4, Application for Employer Identification Number to the appropriate fax number, which you can find here: “Where to File Your Taxes” (for Form SS-4)). You can apply by fax 24 hours a day, 7 days a week. You’ll receive your EIN by fax generally within 4 business days.

Step 6. Comply with Tax Requirements

Death and taxes—the 2 things in life we can’t avoid.

To operate and run daily business activities, you must first get and file any licenses and permits with the state and local agencies, then pay your taxes.

Your state determines your tax filing, license, and permit requirements. You’ll find what you need on the sba.gov website or by contacting your secretary of state’s office.

Tax requirements

From Alabama (that’s ALA-BAM-A for Gump fans) to Wyoming and the 48 states in between, the rules of LLC reporting and tax filing requirements differ.

That said, most states require an LLC to file an annual report and pay an annual tax or fee. And all impose penalties for failing to file a yearly report or paying taxes, and they aren’t cheap.

I recommend you research your state’s tax rules before moving on to step 6, and if you don’t understand them, hire a tax accountant who can help.

Frequently Asked Questions

1. Why should I form an LLC?

An LLC isn’t required, but forming an LLC can help protect your personal assets. Through an LLC, you can open a business bank account, among other things, and it comes with potential tax benefits that allow you to save money. Additionally, an LLC can signal to customers, partners and potential investors that you’re a legitimate business.

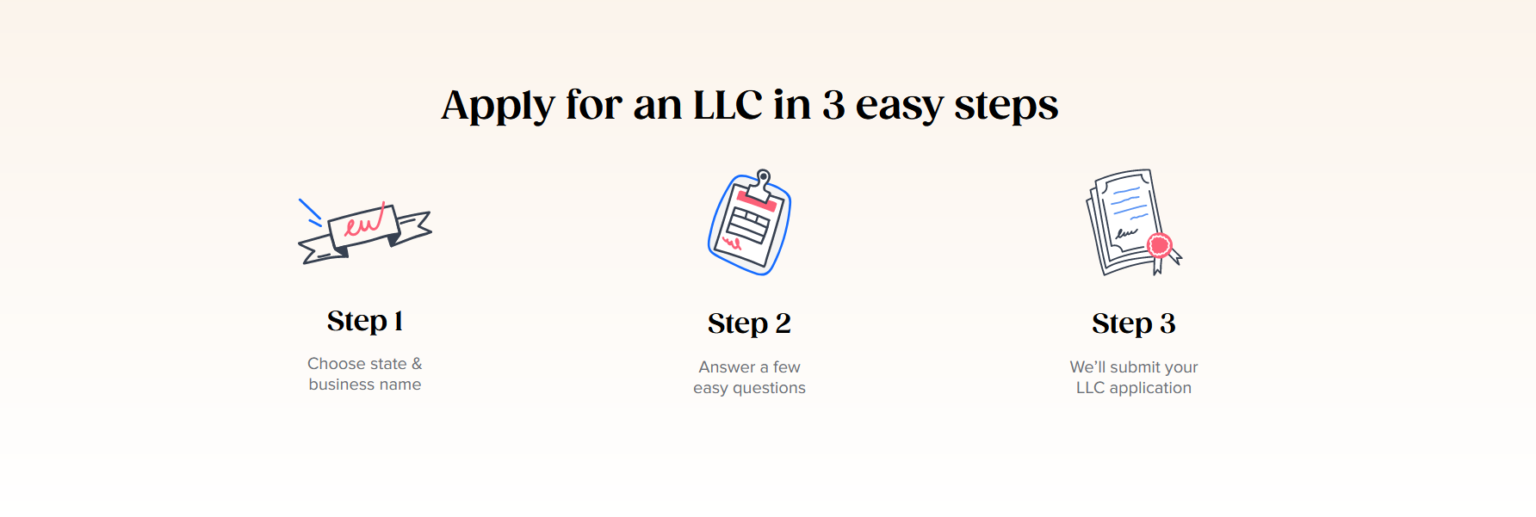

2. How do I form an LLC?

We’ll take care of it for you. Choose from either of our LLC Bundles and get a professional, all-in-one LLC formation service. Simply fill out our online form, and we’ll help you get your EIN (tax ID), apply for an LLC, and more!

3. How much does it cost to apply for an LLC?

The cost for applying for an LLC depends on which state you’re operating in and what licenses you may require for your business. State filing fees range between $50-$500, depending on the state. Additional fees may apply if you choose to hire a professional service to submit your LLC application.

4. What is the difference between a corporation and LLC?

Both corporations and LLCs can protect business owners from liability. That said, LLCs have one or more individual members and are less formally maintained than corporations, while corporations have shareholders, and stricter reporting requirements than LLCs.

5. How long does it take to form an LLC?

This depends on the state in which you’re starting your business. It usually takes between 7 to 10 days to form an LLC.

6. What is a registered agent?

A registered agent, or a statutory agent, refers to a third-party individual or business entity that can accept official documents on behalf of your business. The main purpose of a registered agent is to receive things like tax forms and legal documents, government correspondences, and notices of a lawsuit.

7. Do all LLCs need a registered agent?

In most states, the law requires you to appoint a registered agent when you form an LLC. Registered agents can include a friend you trust, a service like Tailor Brands, or even yourself, as long as the designated person is over the age of 18 and has a physical address in the state where your business is formed.